In Defense of Publishing’s Alternative Business Models

I want to preface this by saying I know that this conversation is old and has gone in endless loops; but I spent last weekend thinking a lot about the ways in which publishers can structure how they work with authors. The publishing houses I oversee, Ulysses Press and VeloPress Books, are considered traditional indie publishers—we pay our authors an advance before publication and then royalties on net revenue as the author’s book sells. There is nothing innovative or interesting about this business model.

What irks me is how stodgy and rigid traditional publishers are in the face of more creative business models (with the emphasis on business). We are, after all, in business to make money and provide for our employees and ourselves.

Getting Authors Lost in Semantics

If you break down the traditional publishing model into more mundane business terminology, this is what it looks like:

An advance is an interest-free loan that, technically, must be returned if it isn’t earned out. (Traditional publishers’ reluctance to “claw back” unearned advances has less to do with our magnanimousness and more to do with failing to be good fiduciaries to our own businesses.) Moreover, since the average advance is now somewhere around $5,000, that means that our authors are much better off getting a job at Starbucks than working on a book. That $5k boils down to getting paid for eight weeks of work at minimum wage (NY). If you know a talented author that can write, edit, revise, and market their book in that amount of time at $15/hour, please contact me immediately.

Royalties, on the other hand, amount to a small percentage of deferred revenue paid once every quarter or six months. Very few people would sell their business or personal IP in other industries for an interest-free loan plus a promise of deferred revenue (with no guaranteed minimum). But traditional publishing puts this model on a pedestal.

Embracing the Alternatives

Hybrid, profit-share, author-services-bundled-with-traditional-publishing (or whatever you want to call the alternatives to the traditional model)—they are just different ways of structuring a business, making money and providing for a company’s stakeholders. Yet if you try to nominate a book for an award as a hybrid, you are required to voluntarily stigmatize your author’s book as coming from something other than normal.

In the hybrid model, authors aren’t paid an advance and are asked to share in both the costs and the rewards. Some of the best publishers I know are hybrids. They take enormous care in producing, printing and marketing their authors’ books. And their authors are rewarded for their work, risk and investment. In return, these hybrids get to produce exceptional books without driving themselves out of business. And, yes, there are predatory hybrid publishers; there are also plenty of bad actors on the traditional side as well, all of which do enormous disservice to their authors’ writing careers.

Considering hybrid “less than” is a slander used by well-established traditional publisher types that were afforded the opportunity to build large backlist cushions during decades (or centuries) when printing, rent, distribution, and overhead were all cheaper and selling books was easier. In my opinion, thumbing their noses is a defensive tool aimed at preventing new competitors from entering the market and taking their authors or challenging their titles’ dominance.

But the reality is that there is no right or wrong way to operate a business—just successful or not. In fact, iterating on the traditional publishing model with common business strategies could be a boon for both authors and publishers. For example, if, instead of an advance and royalty, a publisher offered their authors equity stakes in the whole publishing house, those authors would have the opportunity to profit from shares (albeit slowly diluted over time) in a vibrant company rather than just holding a quickly degrading stake in a single product. In exchange, publishers would immediately cut acquisitions costs and royalty payouts and have more cash on hand to put into salaries, project execution and getting books to customers. There are myriad ways to operate in this business that very few companies have tried out.

Innovate or Die

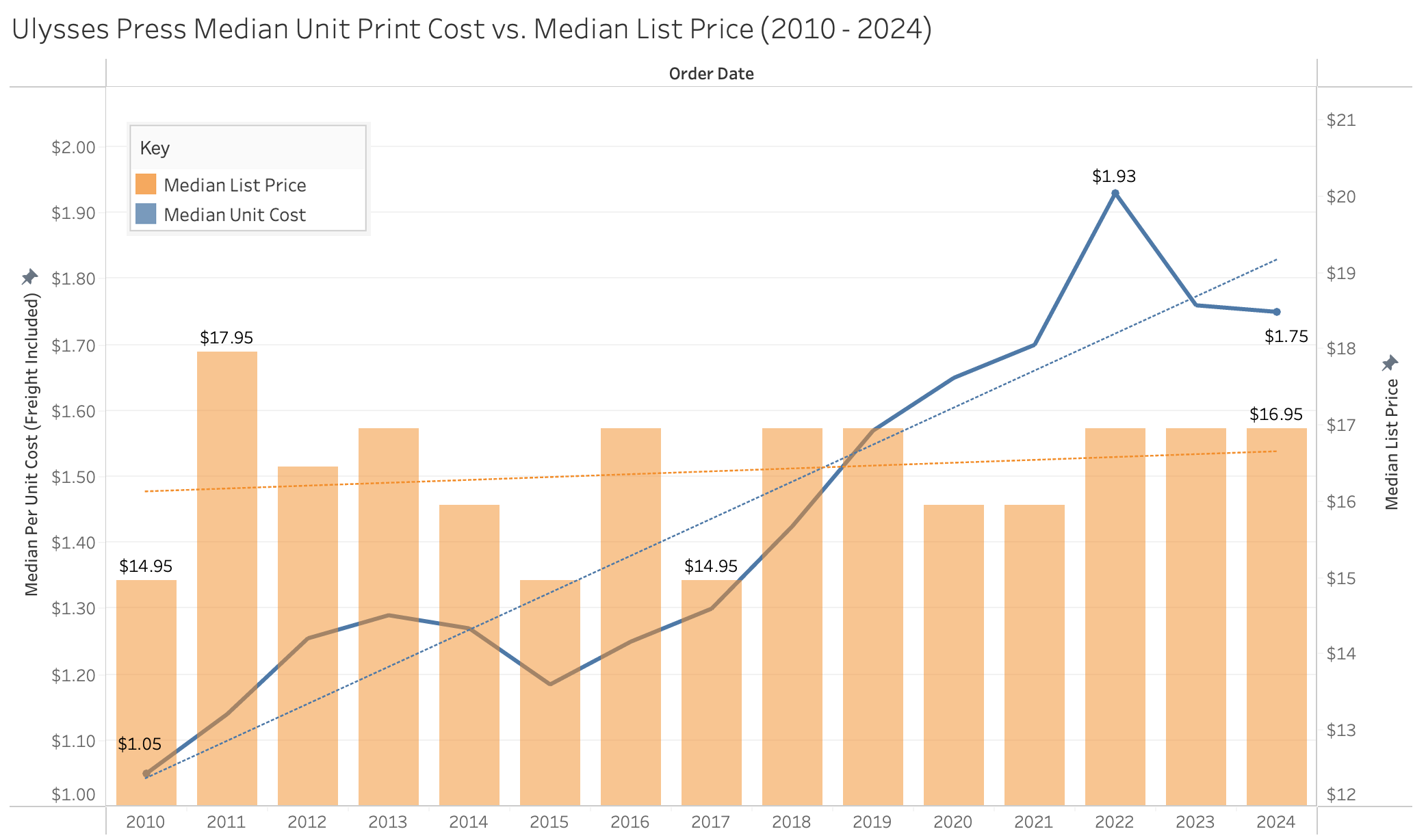

Since 2010, the median cost per unit at Ulysses (including freight) has risen 75%. Our median list price has risen 3% over that same period. That’s not sustainable. (Sponsored self-plug for Perfect Bound—the driving reason our COGS dropped in 2023-2024.)

Publishing books is not going to get easier. There is endless competition for our readers’ attention. There are fewer profitable bookstores and retailers willing to sell books. And the cost of goods has steadily increased while list prices have stagnated. It is time to put the absurd barriers, distinctions and arguments to bed and accept an equal and “all of the above” approach to making books. That is how our industry to survives.