Gauging Amazon’s Incentives

Amazon potentially has a lot to gain from switching from its traditional search experience to one that is steered by ever-more-intelligent AI models. Here are some of the considerations:

1. Better Customer Experience/Conversions: Amazon’s number one goal is to ensure that when a customer visits their website, they make a purchase. Until now, that has meant surfacing the closest products that will satisfy a search (with a whole lot of ads in between). The result rankings are thanks to a complex algorithm that takes into consideration everything from keywords and customer reviews to sales volume. Rufus’ goal is to eliminate all the scrolling and comparing a customer must do and deliver a highly customized result with just three options.

2. Streamlined Operations: If Rufus can home in on the mostly likely purchase every customer will make, that means more predictive inventory planning, smoother fulfillment, and, potentially, fewer SKUs held in each warehouse. In 2023, Amazon’s fulfillment operations cost the company approximately $90.6 billion[iv]; just a ten percent improvement on those expenses would give Amazon savings equal to the entire market cap of a company like Pinterest. Now that’s incentive.

3. Positive ROI on AI: Amazon has invested billions of dollars in developing their AI infrastructure, including a $4 billion investment in Anthropic in addition to developing their own chips, Inferentia and Trainium, for AWS. Eventually, these sizeable investments will pay dividends as Rufus and its following generations train on more and more data from the world’s largest ecommerce platform.

4. Advertising Dollars: On the other side of the scale, however, is Amazon’s mammoth advertising platform, which generated about $47 billion in revenue in 2023[v]. As with Google, it’s yet to be seen how paid search plays a role in a future where AI and search are completely intertwined.

The worst case scenario for the publishing industry is if Incentives 1 and 2 play out in an aggressively negative way. While Amazon has made a killing as “The Everything Store”, it may want to evolve into the “Everything that Actually Sells Store”. In which case, winners and losers in the publishing industry will become rapidly apparent.

The Winners

Category Killers and Bestsellers: Any publishing company that has enjoyed steady sales, great reviews, and consistently high search results for a title on Amazon stands to reap strong revenue going forward. If a book is considered a category killer or was showered with rave reviews or awards, it may no longer have to compete with sponsored competitors or fresh titles. That may end up locking in those titles’ competitive advantage in a certain genre or category for good.

High-Quality Books: The easiest way to make a title highly defensible in the new world of AI-powered search will be to focus on quality. Ideally, AI-driven search would do away with keyword stuffing and search gaming and become a meritocracy of product where the best books win (at least more of the time).

Forecasting: If SGE creates a defensive moat around a publisher’s strongest books, it would make forecasting inventory and sales, both notoriously difficult in publishing, a lot more accurate.

The Losers

Midlist Catalogs: If SGE consistently surfaces only the top books in a catalog, it could severely impact publishers’ midlist books, especially if the titles are in a crowded and competitive category.

Discoverability and Metadata Strategies: Fostering discoverability, which has already become more challenging over the past few years, is going to require even more effort and savvy. Publishers are going to need to work overtime to optimize well-written descriptions, add richer content, drive Amazon purchases from outside, and A/B test constantly to find out what works and what doesn’t. Across large catalogs, that will take enormous resources (although AI will probably help). And what’s more, the rapid evolution of LLMs will require constant vigilance and adjustment from marketing teams as the AI evolves.

Self-Publishing: Small indies and author-publishers will be placed at a further disadvantage if snagging a position within generative results becomes more difficult and more work. In addition, the era of quick-to-market books aimed at selling through gamed SEO and keywords will slowly fade.

How We are Adapting

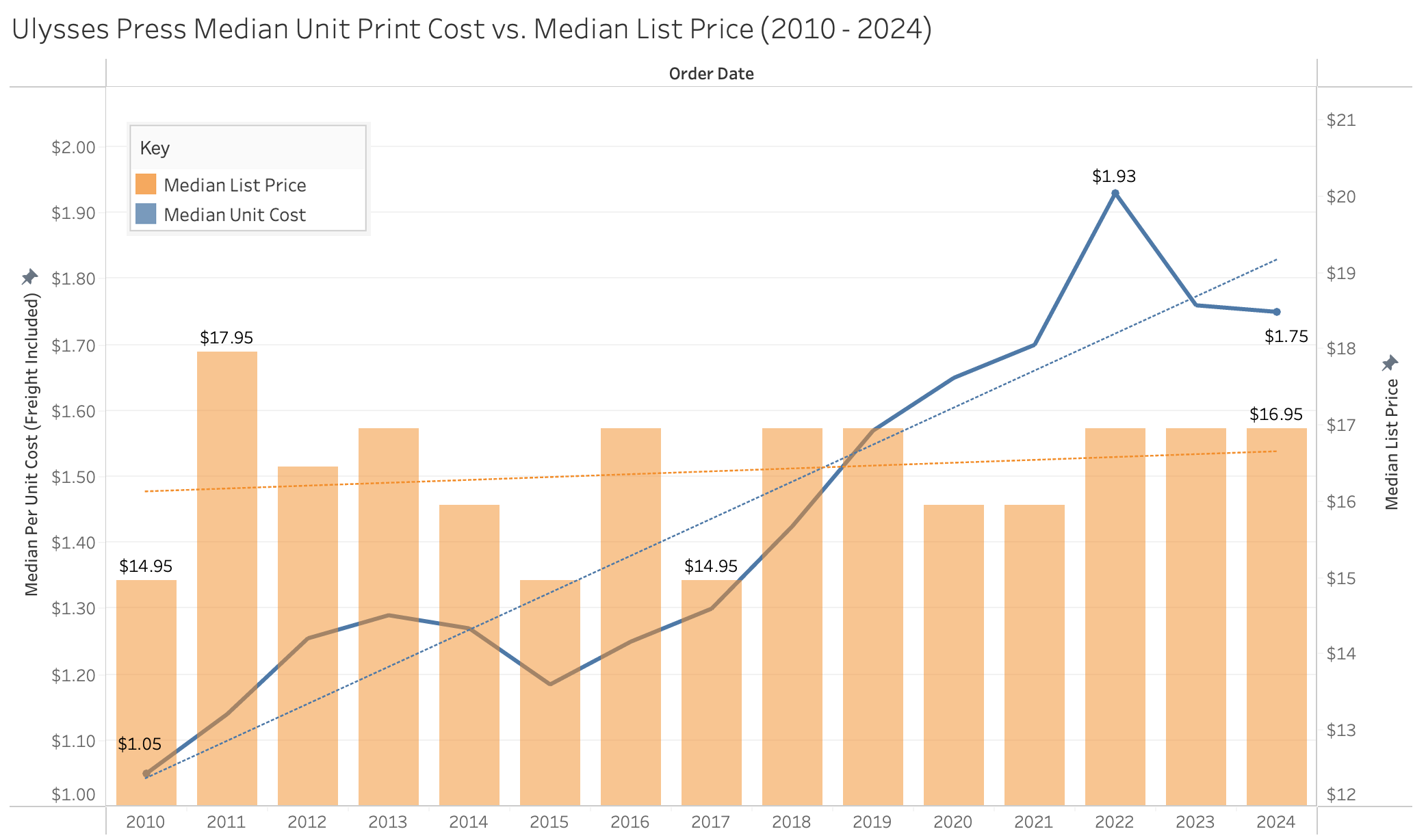

Since the early 2000s, Ulysses Press has successfully leveraged data, statistics and market research to acquire on-trend and niche titles. While data is still very much going to inform our acquisitions decisions, our editors will undoubtedly need to become more selective about the titles we invest in as we move into 2025 and 2026. In addition, we will need to pour more resources and time into uncharted Generative Engine Optimization strategies.

Whether all these AI-driven changes come to fruition is beyond me. Consumer habits when it comes to online shopping are stubborn (we’ve been content with the same Amazon user experience for two decades now). But shopping behaviors do evolve—20 years ago I wouldn’t give websites my credit card; now I’ll buy toilet paper by yelling at a cylinder in my living room. I honestly don’t know what shopping on Amazon will look like in five years, but if it’s anything like what I expect, it will upend my business model. And that’s something I’d like to be prepared for.

[i] https://searchengineland.com/how-google-sge-will-impact-your-traffic-and-3-sge-recovery-case-studies-431430

[ii] https://www.searchenginejournal.com/google-sge-organic-traffic-impact-divided-by-verticals/514800/

[iii] Similarweb.com

[iv] https://ir.aboutamazon.com/news-release/news-release-details/2024/Amazon.com-Announces-Fourth-Quarter-Results/default.aspx

[v] https://www.statista.com/statistics/1305698/amazon-advertising-revenue/